Maximize Your Refund with Expert Tax Preparation

The Role of Expert Tax Preparation

Maximizing your refund starts with accurate and thorough Tax preparation. Many taxpayers leave money on the table due to overlooked deductions or incorrect entries. Expert tax preparation ensures every credit and deduction is applied correctly, helping you receive the maximum refund possible. With the right guidance, tax preparation becomes both efficient and rewarding.

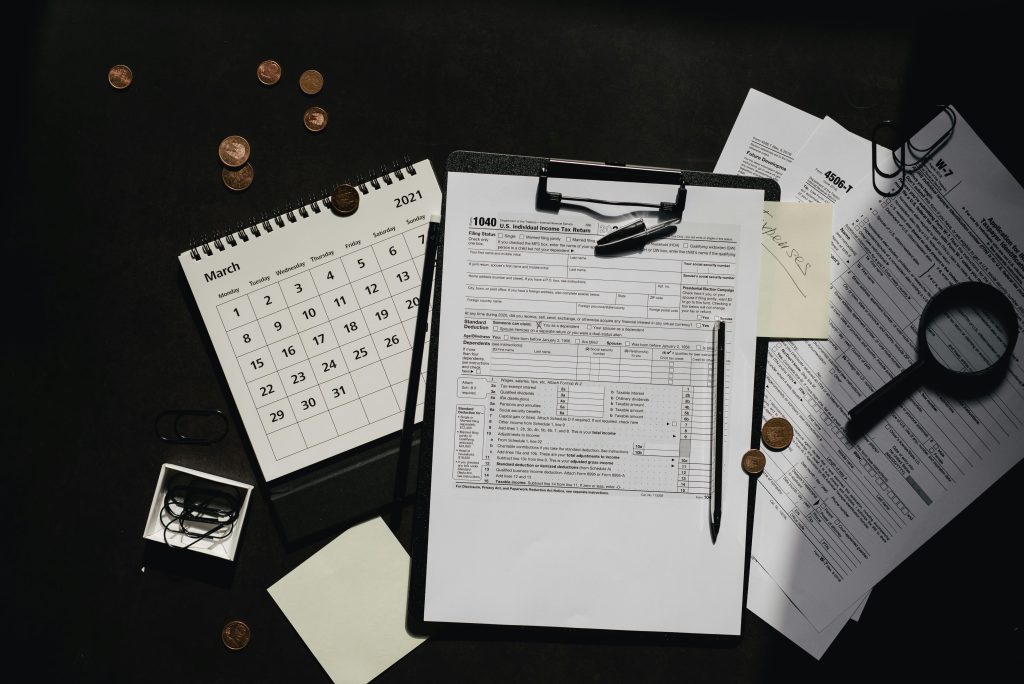

Organize Your Financial Documents

Effective tax preparation begins with organized records. Collect income statements, receipts, and relevant financial documents before starting. Proper organization allows your tax preparation to be faster, reduces errors, and ensures you claim all eligible deductions. Well-prepared documentation is a cornerstone of successful tax preparation.

Leverage Expert Tools and Software

Using expert tools like Taxfinity can enhance tax preparation significantly. These platforms provide step-by-step guidance, automated calculations, and error checks. By relying on expert tax preparation software, you streamline the filing process and reduce the likelihood of mistakes, making your tax preparation more accurate and efficient.

Identify All Eligible Deductions and Credits

Maximizing your refund requires knowing which deductions and credits apply to your situation. Expert tax preparation identifies opportunities you might otherwise miss. By carefully reviewing your financial information, you ensure your tax preparation is optimized to achieve the highest possible refund. Accurate tax preparation is key to financial advantage.

Plan Ahead for Tax Filing

Timing matters in tax preparation. Planning ahead allows you to review documents, track deadlines, and submit your return without stress. Early tax preparation ensures you can double-check entries, consult experts if needed, and maximize potential refunds efficiently. Strategic planning is a fundamental part of expert tax preparation.

Avoid Common Tax Preparation Mistakes

Errors during tax preparation can lead to delays, audits, or reduced refunds. Expert tax preparation focuses on accuracy, verifying all calculations and ensuring compliance with tax laws. By minimizing mistakes, you improve the reliability of your tax preparation and enhance the likelihood of a full refund.

Take Advantage of Professional Guidance

Professional advisors provide insight into complex tax rules, helping with specialized deductions or multiple income streams. Consulting experts ensures that your tax preparation is thorough and correct. With professional guidance, your tax preparation becomes smarter, more precise, and better positioned to maximize your refund.

Secure Online Tax Preparation

Online tax preparation platforms allow you to complete your filing safely and conveniently. Digital tools streamline the process, provide secure data storage, and facilitate submission. Using secure platforms for tax preparation ensures your information is protected while allowing you to maximize efficiency.

Review and Submit Confidently

Before submitting, review every aspect of your tax preparation. Ensuring all entries are accurate and all deductions are claimed is essential for a successful refund. Careful review guarantees that your tax preparation is complete, minimizing the risk of mistakes and increasing the potential for a maximum refund.

Conclusion

Expert tax preparation is the key to maximizing your refund. By organizing documents, using advanced tools, identifying deductions, and reviewing carefully, you can complete tax preparation accurately and efficiently. Whether using software or professional assistance, expert tax preparation ensures you receive the full benefit of your tax return and experience a stress-free filing process.